WHAT ARE OPTIONS AND HOW DO THEY WORK?

Options are derivative contracts relating to a specific underlying instrument, like a stock, where the contract owner has the choice to buy or sell 100 shares at an agreed-upon price and expiration date. Learn more about options flexibility and risks in this guide.

WHAT IS AN OPTION?

An option is a standardized financial derivative contract that gives the owner the right to buy or sell 100 shares of an underlying asset at a specific price, referred to as the “strike price,” at or up to the expiration date.

Call and put options are the two types of options, and more complex strategies simply combine these two types of options from the long (bought) or short (sold) side.

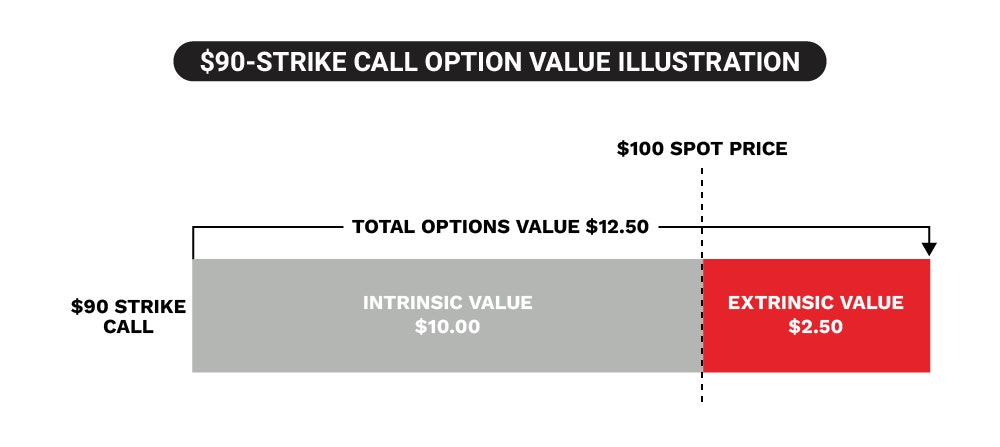

The option contract’s total premium value refers to the price at which an option contract currently trades, which includes intrinsic value, and extrinsic value based on external factors.

Extrinsic value premium depends on the underlying asset’s price in relation to the strike price, how volatile the product is perceived to be, and the period of the options contract.

In any case, option owners have significant leverage compared to buying 100 shares of stock outright, simply because they can control the theoretical equivalent of 100 shares of stock for a limited amount of time.

Options that expire in a week will be cheaper than options that expire in a month, but the main point here is that they expire. 100 shares of stock can be held perpetually, where options contracts exist for a limited period, which is why they are cheaper than buying or shorting 100 shares outright.

STOCKS VS OPTIONS: WHAT’S THE DIFFERENCE?

Some differences between stocks and options include:

| Stocks | Options |

|---|---|

Financial instrument that gives you direct exposure to the stock price and ownership | Financial derivative contract that allows you to create much more flexible trading strategies |

Static directional exposure – your stock profit and losses are perfectly correlated to how the stock price moves | Dynamic directional exposure – Factors such as time to expiration on the options contract, and where the options contract is relative to the stock price can change your profit or loss implications |

If your directional assumption is incorrect, you incur a loss | Certain options strategies do not rely on a directional assumption |

No time limit to close your position | Options have an expiration date, and options that have real value at expiration can turn into 100 long or short shares of stock at expiration if they are not closed |

Lack trade flexibility | Plenty of trade flexibility (strike price, expiration choices, Greek exposures, strategies, etc.) |

Subject to pattern day trading (PDT) rules, as stocks are securities | Subject to PDT rules as well |

WHY TRADE OPTIONS

INCREASED FLEXIBILITY

Strategic flexibility to reflect your market assumptions, whether you are bullish, bearish, or neutral

NON-LINEAR EXPOSURE

Get more strategy flexibility as potential profits are not only dependent on a directional assumption

CAPITAL EFFICIENCY

Access higher potential return on capital with leverage, while reducing your trade’s cost basis

HEDGE AGAINST RISK

Offset risk in your portfolio, including fluctuations in volatility

Reduce Cost Basis

Reduce cost basis on long or short stock positions in your portfolio using different strategies

TRADE AGAINST TAIL RISK EVENTS

Utilize options to trade or hedge against unusual fluctuations in prices caused by low-probability events

HOW DO OPTIONS WORK?

Options give traders flexibility around the markets they are trading, but before more complex strategies are introduced it is important to understand how calls and puts are priced, and how they work from the long and short side – after all, complex strategies are just combinations of long and/or short calls and/or puts.

INTRINSIC AND EXTRINSIC VALUE

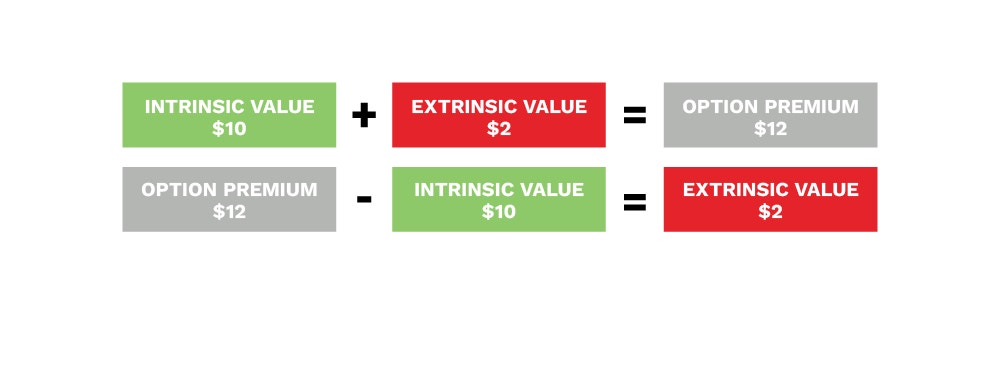

When trading options, it is vital that you understand intrinsic and extrinsic value, as intrinsic and extrinsic value make up the total value of an option’s price.

INTRINSIC VALUE

Intrinsic value is real value to the option owner at expiration. Intrinsic value is determined differently in call and put options.

A call option has intrinsic value if the underlying price is above the strike price, as it gives the call option owner the ability to buy 100 shares of stock at a lower cost basis than the outright stock market.

A put option has intrinsic value if the underlying price is below the strike price, as it gives the put owner the ability to sell 100 shares of stock at a higher value than the outright stock market.

EXTRINSIC VALUE

Extrinsic value refers to any value an option has that is not intrinsic value. This is based on how much time is left to expiration, the distance of the option from the stock price, and implied volatility (IV).

When there is more time left to expiration, the option contract’s extrinsic value will be higher than a contract with less time to expiration on the same stock. Expectations of big market price movements (high IV) can also mean more extrinsic value.

If a 40-strike put option is trading for $4.50 when the stock is at $36, there is $4 of intrinsic value in the contract as it allows the put owner to sell 100 shares of stock at $40 instead of $36. Since it’s trading for $4.50, there is $0.50 of extrinsic value in the contract.

Adding up the intrinsic and extrinsic value gives you the total option premium or price. That means if you know what the option premium is and the intrinsic value (if applicable), you can calculate the extrinsic value.

For the example above, if a 90-strike call option is trading at $12.50 when the stock is at $100, there’s $10 of intrinsic value in the contract as it allows the call owner to buy 100 shares of stock at $90 instead of $100. Since it’s trading for $12.50, there is $2.50 of extrinsic value in the contract.

IN-THE-MONEY, OUT-OF-THE-MONEY, AND AT-THE-MONEY

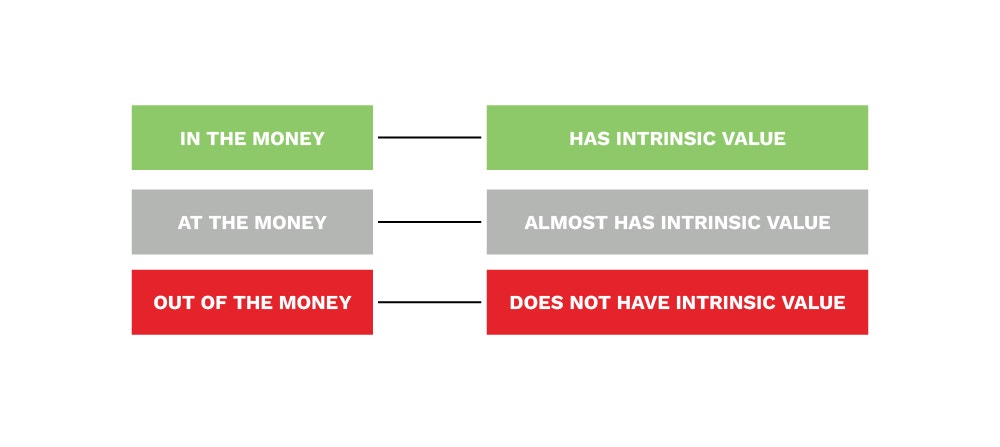

In-the-money (ITM), out-of-the-money (OTM), and at-the-money (ATM) are terms that describe a long or short option contract’s strike price relative to a stock’s current price.

So, what does each term mean?

- ITM means that the option has intrinsic value. The intrinsic value is determined by the difference between the underlying asset’s price and the option’s strike price. A call option is in the money when the asset’s price is greater than the strike price, while a put option is in the money when the asset’s price is below the strike price.

- OTM options have no intrinsic value, they only have extrinsic value, and they will be worthless if they remain OTM through expiration. That means if you bought the option, you would realize max loss. If you sold the option to open, you will realize a max profit if it expires OTM.

- ATM options are those with strikes closest to the current stock price—in this case, the option almost has intrinsic value, or may have a little intrinsic value. The extrinsic value on these options is the highest compared to deep OTM and deep ITM options, due to the uncertainty of whether the option will have intrinsic value or not at expiration.

EXPIRATION DATE

The expiration date is the day at which an option expires and either converts to 100 shares of long or short stock or expires worthless.

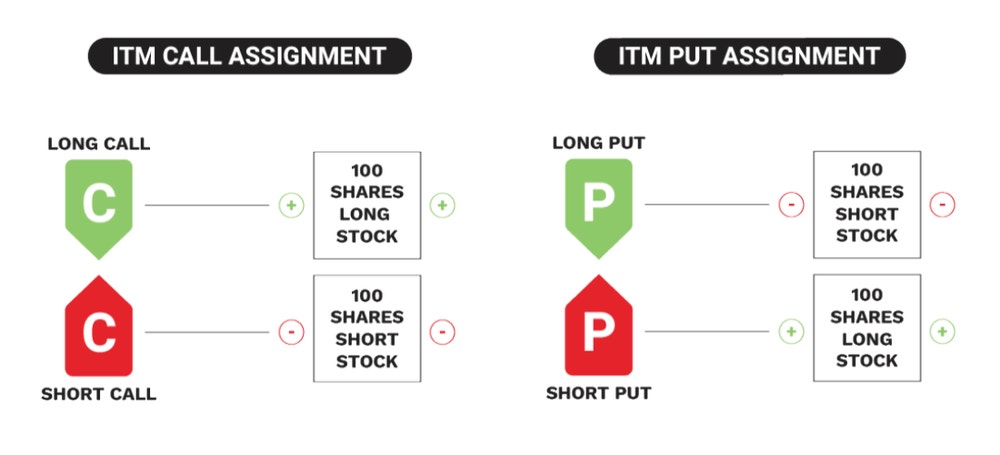

If an option is held through expiration and remains ITM, it will be converted to 100 long or short shares depending on the option type—long options are technically exercised, while short options are assigned.

| Action | Calls | Puts |

|---|---|---|

Short assignment | -100 shares/contract | +100 shares/contract |

Long exercise | +100 shares/contract | -100 shares/contract |

Long calls and short puts will be converted to 100 long shares per option contract, and long puts and short calls will be converted to 100 short shares of stock per option contract.

If an option does not have intrinsic value, and remains OTM through expiration, it will expire worthless and disappear from the account by the next trading session.

Options contracts have standard monthly expirations, with the expiration date landing on the third Friday of each month.

However, some popular stocks also offer weekly options that expire each Friday, quarterlies that expire at the end of each quarter, and end-of-month (EOM) contracts are also available but are mainly offered on equity index ETFs.

Some of the most active products even offer daily expiration contracts, so many products offer much more expiration flexibility than just the standard monthly cycle.

Option holders can exercise their right to buy or sell the underlying asset before the expiration date, typically when the option is ITM. Just be aware that if you’re exercising an option to convert it to stock, you are giving up any extrinsic value remaining in the option itself, which is real value over the option’s intrinsic value. This is why early assignment is not common, but it is possible for short options. To retain the extrinsic value, options traders sell the option to capture both the intrinsic and extrinsic values and may get long or short shares at the market price after the fact.

Equity and ETF options at expiration:

- tastytrade will exercise any long options that are at least $0.01 in-the-money (ITM)

- Long options that aren’t at least $0.01 ITM expire worthless

- Short options are usually assigned automatically if they’re ITM and held through expiration but that is not always the case if the market moves the strike OTM shortly after the close

- Options can expire OTM and move ITM in after-hours trading, and vice-versa, which could lead to potential assignment; to avoid assignment risk altogether, short options traders avoid holding positions that are near the stock price through expiration by closing their positions

- Defined risk strategies like vertical spreads can turn into 100 shares of stock long or short if one option expires ITM and the other option component expires OTM

HOW ARE OPTIONS PRICED?

Most trading platforms use the Black-Scholes model to price options, and the prices are presented for you in real-time on the platform. With the heavy calculation out of the way, it’s still important to focus on intrinsic and extrinsic value, and how options change in price depending on stock price movement to have a good understanding of how your option is priced.

- If the stock price rises: the price of a call option is likely to climb, but a put option’s price usually falls

- If the stock price drops: call option prices often experience a dip, but put options prices commonly rise

Extrinsic value Is less linear in nature, and is made up of a few components:

- Time to expiration: options with more time left to expiration have more extrinsic value

- Implied volatility (IV): options with higher IV have more extrinsic value

- Distance from stock price: options with strike prices that are further from the stock price have less extrinsic value than strikes closer to the stock price. Think of extrinsic value as an umbrella that follows the stock price—the strikes that are ATM will typically have more extrinsic value than strikes ITM or OTM

WHAT IS A CALL OPTION?

A standard equity call option is a contract you can trade that represents 100 shares of long stock at the strike price you choose, which you can exercise at or before the contract’s expiration date to convert it to 100 shares of stock. You can also sell the contract outright and just trade the difference of entry vs exit price, which is generally more popular than obtaining shares.

Like trading stocks, you can buy-to-open (long & bullish) or sell-to-open (short & bearish) a call option.

When you buy a call option, you have a right (but not an obligation) to exercise the option at your strike price anytime up until expiration and convert your option to 100 shares of stock at your strike price.

However, when you sell call options, that means you are obligated to sell the underlying shares at the set strike price any time up to expiration to the counterparty if the option is exercised—this is known as assignment.

This could result in 100 short shares if you do not already have 100 long shares to cover the assignment. Early assignment for in-the-money options is rare, but the chances of early assignment increase for short ITM calls when extrinsic value is low, or an upcoming dividend payment is greater than the extrinsic value left in the option. A call option that expires at least $0.01 ITM and remains ITM will automatically be converted to 100 shares of stock.

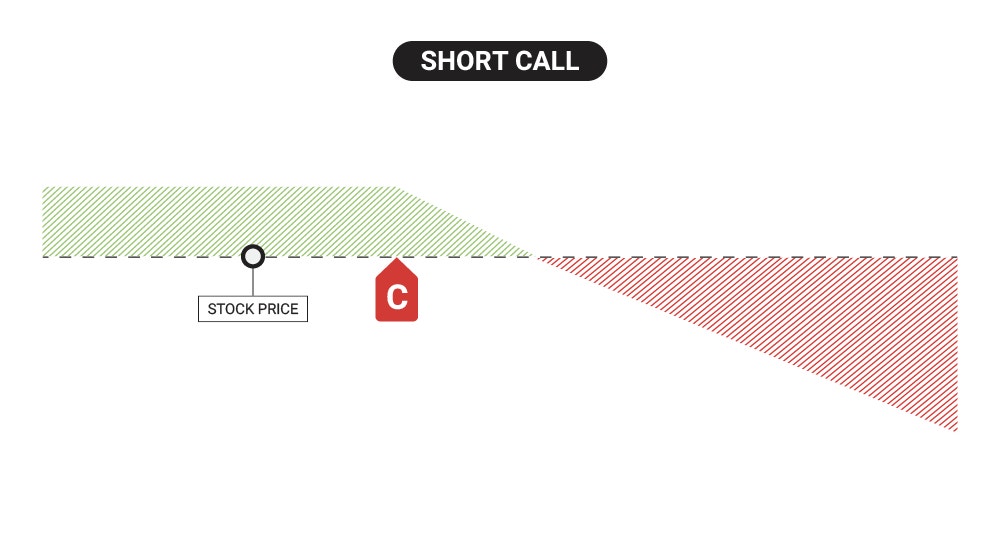

Each call option transaction has two sides: the buyer’s side, where the owner speculates that the stock price will go up and the seller’s side, where the seller speculates against the stock price moving up past the short call strike over the course of the contract.

With a short call option, you are obligated to assume the risk of 100 short shares of stock at your strike price if the stock price goes above your strike price.

That said, it is important to monitor your trades and close them before expiration when the asset price is moving in an unfavorable direction.

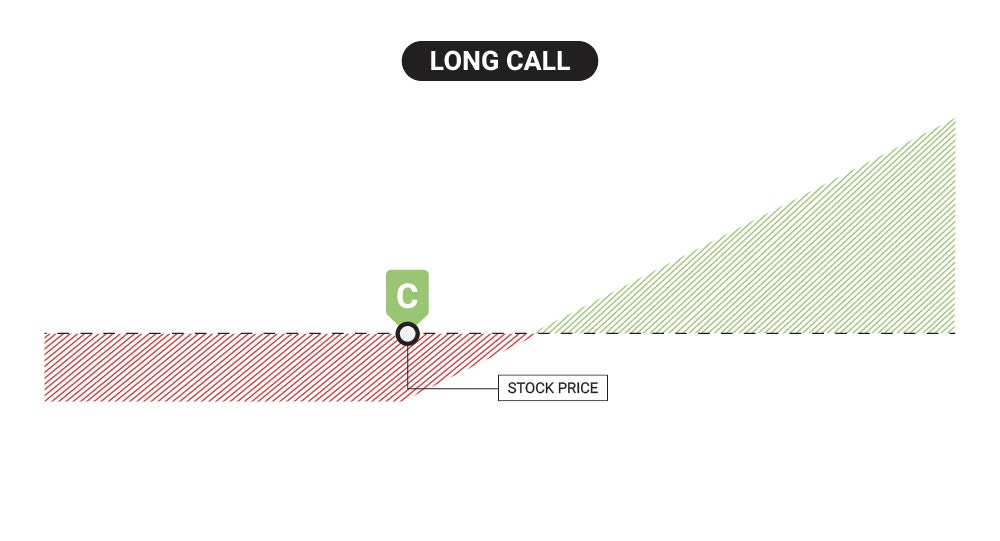

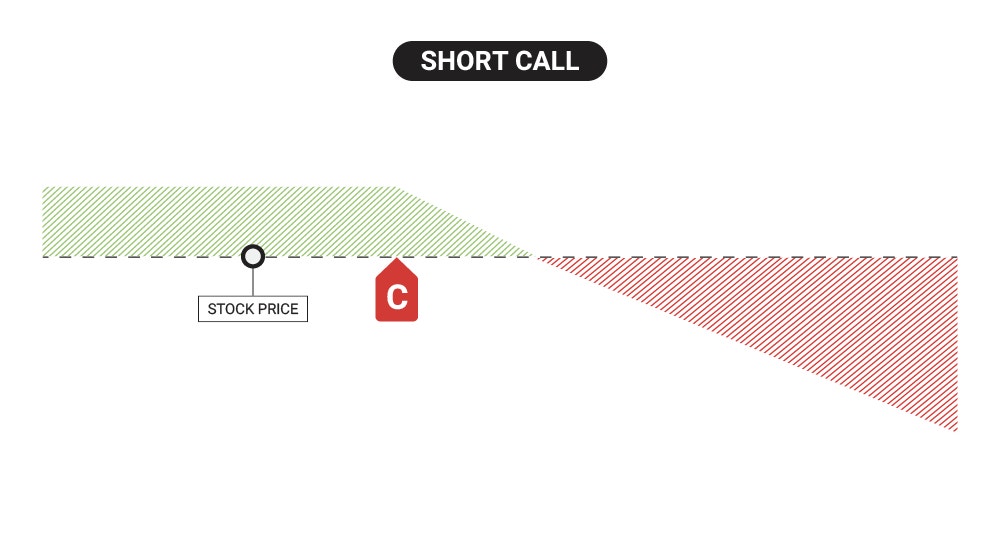

PROFITS AND LOSSES IN CALL OPTIONS

There are several conditions that typically determine whether call option positions are profitable or not.

| Potential Profits | Potential Losses | |

|---|---|---|

Long Call |

|

|

Short Call |

|

|

WHAT IS A PUT OPTION?

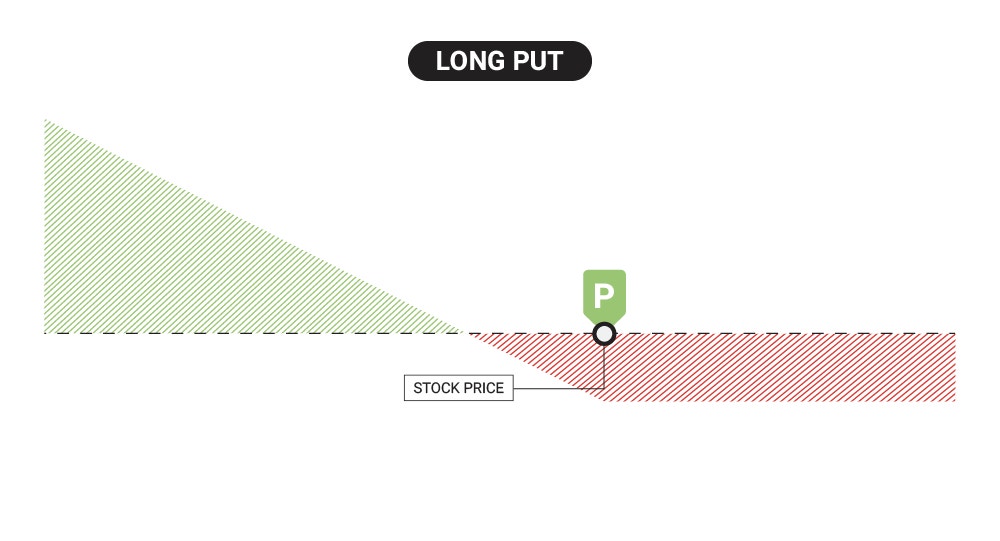

A standard equity put option is a contract you can trade that represents 100 shares of short stock at the strike price you choose, which you can exercise at or before the contract’s expiration date to convert it to 100 shares of short stock. You can also sell to close the contract outright and just trade the difference of entry vs exit price, which is generally more popular than obtaining short shares.

Like trading stocks, you can buy-to-open (long & bearish) or sell-to-open (short & bullish) a put option.

When you buy a put option, you have a right (but not an obligation) to exercise the option at your strike price anytime up until expiration and convert your option to 100 shares of short stock at your strike price.

However, when you sell put options, that means you are obligated to buy the underlying shares at the set strike price any time up to expiration to the counterparty if the option is exercised —this is known as assignment.

This could result in 100 long shares of stock if a short put is assigned prior to expiration. Early assignment for in-the-money options is rare, but the chances of early assignment increase for short ITM puts when extrinsic value is low. A put option that expires at least $0.01 ITM and remains ITM will automatically be converted to 100 shares of stock.

Same as with call options, one standard put contract represents 100 shares of a stock; and a long put and a short put signify the two opposing parts of a transaction—the exact inverse of call options.

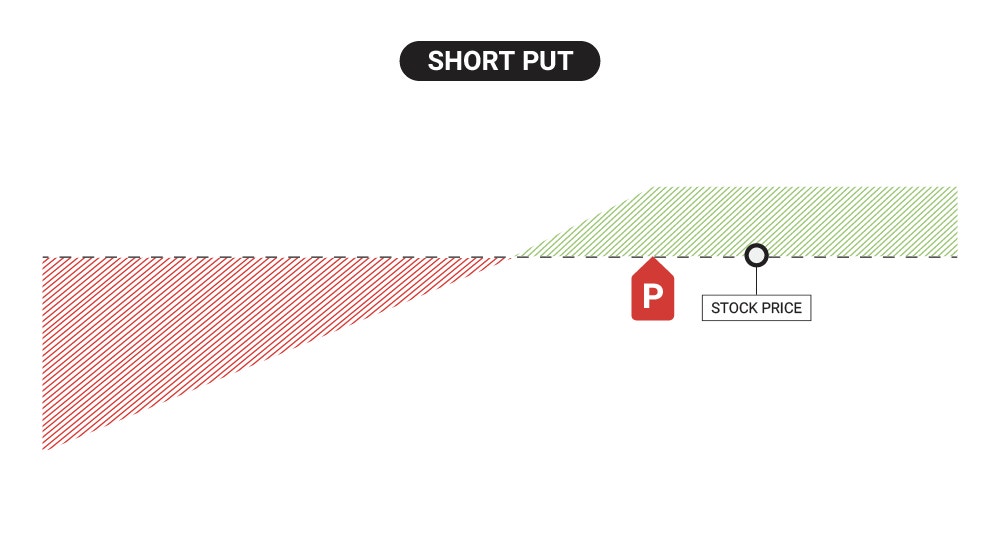

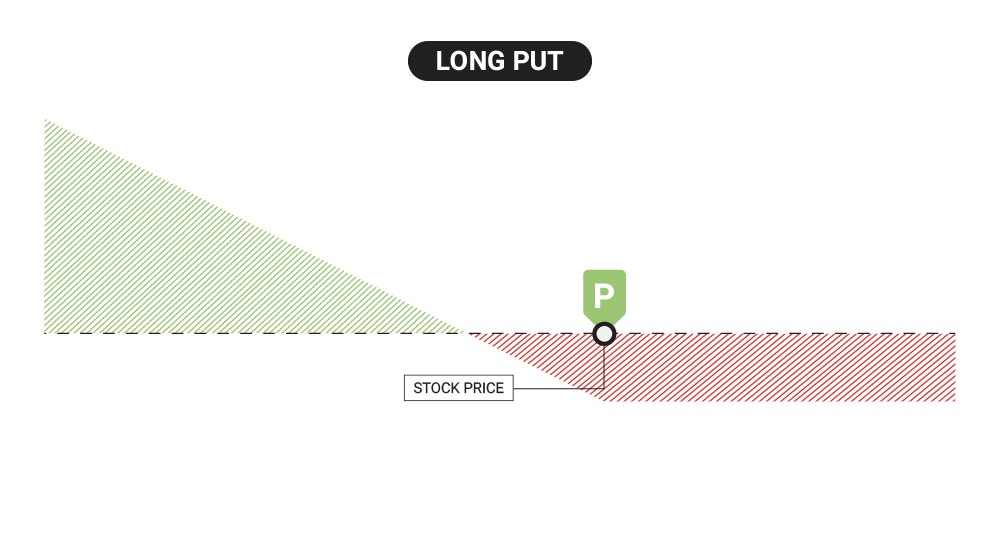

PROFITS AND LOSSES IN PUT OPTIONS

There are several conditions that typically determine whether put option positions can be profitable or not.

| Profits | Losses | |

|---|---|---|

Long Put |

|

|

Short Put |

|

|

BUYING VS SELLING IN OPTIONS TRADING

LONG CALL EXAMPLE

Options trading examples are a practical way to help you put theory into practice. Let’s have a look at a long call option example.

Suppose you’re bullish on Company XYZ stock and you buy a call option with a $90 strike price. At the expiration date of your options contract, the stock is trading at $100. With a strike price of $90, there’ll be $10 of real (intrinsic) value as you can purchase the shares for $10 less than the market price right now.

If the stock price were at $80 per share at expiration, rather than $100, the $90 strike call option would be worthless as there’s no intrinsic value. This would result in full loss of the debit paid up front for the call option.

However, before expiration, all options have some extrinsic value because there is still uncertainty around where the stock price will be at expiration. This uncertainty is magnified in a high IV environment if the contract has a lot of time to expiration, or a combination of both. In this case, if the stock is at $100 and your strike is at $90 and the option is trading for $12 like what is shown below, there is $2 of extrinsic value in the option and $10 of intrinsic value.

This $2 of extrinsic value will decay to $0 at expiration, and the option will be left with either some sort of intrinsic value if it is ITM, or it will be worthless if it is OTM.

Now let’s say the $90 call was purchased for $6 when the stock was at $80, prior to the stock’s rally to $100.

If the call was trading for $6.00 and it is now trading for $12 or $1,200 real dollars, the trader would realize a 100% return on capital if the option was closed prior to expiration and the profit was secured.

If the trader owned 100 shares instead and bought the stock at $80 and realized a rally to $100, they would make $2,000 which is a 25% return on risk.

The big difference here is that the call option holder has significantly less monetary risk, as they purchased the option for $6 or $600 real dollars and can only lose that amount by the option’s expiration date. The stockholder has $8,000 of risk if the stock were to go to $0.

The call option holder has a higher potential return on capital as well, since they have the temporary ability to buy 100 shares of theoretical stock with the call option. With this higher potential return on capital comes a higher potential % of loss as well, so traders must be aware of options are priced and how they can and will change in price over time.

Neither trade is better or worse, it’s just the trade-off that is inherent with stock vs options trades.

SHORT CALL EXAMPLE

A call seller is trading against the movement of a stock price above the call strike, and they assume 100 shares of short stock risk above the call strike. In exchange for this risk, the OTM call seller collects extrinsic value premium up front.

The seller of a call would keep the entire premium collected up front as max profit if the underlying is below the strike price at expiration.

Risk is unlimited for a short call as there is no cap on how high a stock price can go.

Let’s say XYZ stock is trading at $100 a share and a trader that is bearish decides to sell a $110 strike call for $2.50—the max profit on this trade is $250 if XYZ stock stays below $110 at expiration, as the option would expire worthless and not take on any intrinsic value.

This means that the stock can even rally a few points and the short call holder would still be profitable at expiration, which is why there is some flexibility associated with OTM short premium trades like short calls and short puts.

If the stock were to rally to $115 and the contract was closed at $5, the options trader would lose $250. The option would be worth $500 and the trader would have to buy it back to close the trade, but they collected $250 up front which offsets half of the loss.

LONG PUT EXAMPLE

A put option gives the owner the right to sell 100 shares of an underlying asset at the strike price by the expiration date. The buyer of a put option assumes a bearish bias, speculating on a decline in the price of the underlying asset and can be profitable if the market does decline by the expiration of the options contract.

For example, if XYZ stock is trading at $60 and a selloff to $48 in XYZ would result in a $1,200 profit for short stock. Keep in mind, 100 short shares of stock would have unlimited risk.

If a trader buys a $60 strike put instead that expires in 30 days, it may cost them $3.00 or $300 in real dollar terms. Since the put is not yet ITM, this $300 is pure extrinsic value.

If XYZ sells off to $48, that put would be worth $1,200 at expiration resulting in a $900 profit or 300% return if the put option is closed. With that said, if the stock didn’t move and remained at $60 after 30 days, the put buyer would lose 100% of the value invested in the contract.

As you can see, options can be much more volatile than buying or selling 100 shares of stock outright, but the tradeoff is a lower capital outlay for similar share exposure if the strike is ITM or moves ITM at any point in the trade.

SHORT PUT EXAMPLE

Traders can also sell an options contract, otherwise known as writing an option. A seller of an option speculates against the movement of the underlying and receives a premium upfront for assuming the risk of the shares.

In the same example above, let’s assume the trader decides to sell $60 strike put in XYZ when the stock is trading at $60—they collect $3 for selling the put.

Over the duration of the contract, XYZ stock moves up and down but eventually lands at $61 at expiration.

In this case, the trader would keep the total premium received of $300 as max profit, since the put expired OTM and worthless and did not take on intrinsic value at expiration.

If the stock retreated to $55 instead at expiration, the $60 strike put option would be worth $5 or $500 in real-dollar terms, and the options trader would lose $200 if the contract was closed. The trader would have to buy back the put for $5, but they collected $3 up front for selling the contract, which offsets $3 of risk in the closing transaction.

EXERCISE VS ASSIGNMENT IN OPTIONS TRADING

The difference between exercise and assignment depends on whether you’re long or short the option. If you own a call or put option (long), you have the right to exercise the option contract and convert it to 100 long or short shares, respectively.

That means assignment can only happen if you have a short call or a short put position. The party with the right to exercise the option doesn’t have an obligation to do so—but if it is going to happen, they typically exercise the option when their option is in-the-money (ITM). They can typically exercise at any time up to the expiration, and you as a short option holder have the obligation to buy or sell 100 shares at the strike price of your option contract.

Assignment risk can increase in the case of dividend payouts (dividend risk applies to short ITM calls).

An exchange sets the ex-dividend date when a corporation declares a record date and payable date for a dividend. Even if a short call option moves ITM, if there is a lot of extrinsic value left in the option, assignment risk is typically low because that value is lost when the option is converted to shares.

So, in the case of dividend payments, the dividend payment generally must be more than the extrinsic value amount in an ITM short call option for it to make sense for the counterparty to exercise the option. If the extrinsic value is higher than the dividend, assignment is less frequent.

Simply put, exercising an option occurs when the holder “exercises” their right to buy or sell the underlying security according to the specified price. Assignment occurs when the option seller is obligated to buy or sell the underlying security at the specified strike price. ITM options that are held through expiration and remain ITM are automatically converted to 100 shares of stock by the broker.

Trading options on tastytrade

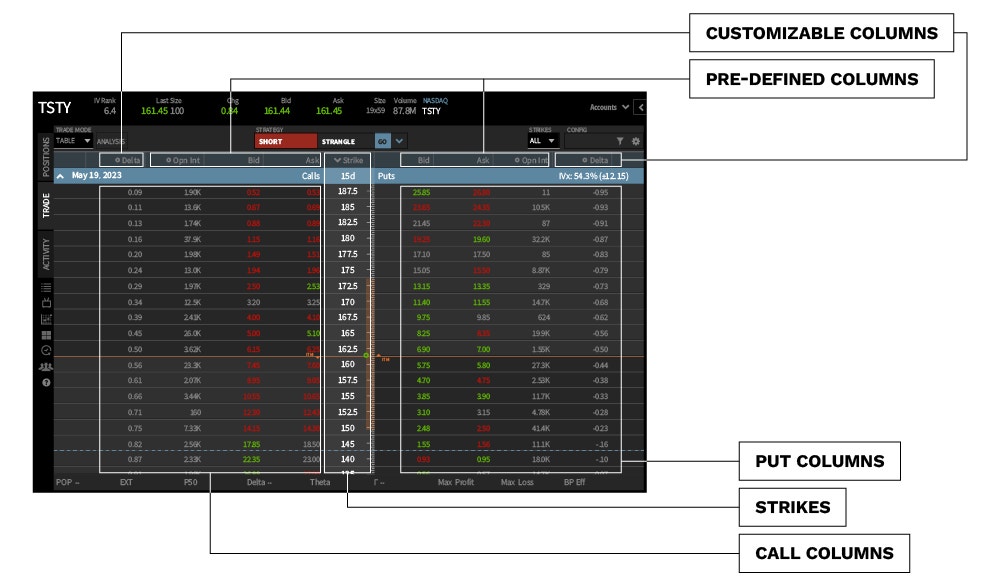

Option Chains

Option chains is a tool that traders use to view current bid and ask prices that a particular option is trading at, listed by strike price and expiration date. A trader that wants to buy or sell an option would look at the options chain to view and analyze their current or potential trades.

Clicking on the ask price of an option will load an order to buy it, and clicking the bid price of an option will load an order to sell it.

In addition to the bid and ask prices, an options chain on the tastytrade platform has the ability to list additional details that could better inform a trader. Those include an option’s probability of expiring ITM, activity measures like volume and open interest, and much more.

HOW TO READ AN OPTIONS QUOTE

You can find pricing information for your trade in the positions tab on the tastytrade platform. There you’ll see data such as:

- The asset or ticker symbol that the option or position is tied to

- The price change of the underlying asset today

- Current market price for the underlying

- Days to expiration

- Strike price

- The type of option (call or put)

- Whether it’s ITM, OTM, or ATM

HOW TO START TRADING OPTIONS

- Develop a strong fundamental understanding of how options and strategies work

- Create an account or log in

- Have a plan for profit targets, defensive adjustments, and ultimately understand your risks associated with strategies you deploy

- Trade and manage your options positions

FAQ

An option is a financial derivative contract that gives you the right to buy or sell 100 shares of stock on an underlying instrument at a predetermined price by the expiration date.

Because of this limited timeframe, options are less expensive than buying 100 shares of stock outright, and with that comes more volatility of the options trade.

Stock options give you more flexibility compared to outright stock positions as well. Instead of taking a pure, static long or short stock position, options give you the opportunity to employ a range of strategies and add several variables—such as strike price and time to expiration—which could be beneficial for you if you’re trying to fine-tune your risk and directional assumption.

Options are not suitable for all investors, and you must understand the risks of options trading fully.

Examples of purchasing an option can be one of two types: a call option and a put option. If you’re bullish on the underlying asset’s price, you might buy a call option or sell a put option. Whereas if you’re bearish, you might sell a call option or buy a put option.

Long call options increase in value and short put options decrease in value as the stock price rises quickly. If the market doesn’t behave the way the trader wants, these options can also move against the trader in the same way. Long calls can lose value if the stock drops and short puts can increase in value.

If you buy to open a call option, an increase in stock price could result in profitability since you can now sell it for more than what you bought it for. If the stock price drops, the call option can decrease in value as well, resulting in losses if you close it for less than what you bought it for.

If you sold to open a put option, this could also result in profitability if the stock price rises since you sold the option for a higher amount than what it’s trading for now as the increase in stock price would mean that your short put strike is further away from the current price and could be a lower value to buy back to close the trade. If the stock price drops, the short put option can increase in value resulting in a loss if you buy it back for more than what you sold it for up front.

Long put options increase in value and short call options decrease in value as the stock price drops—the exact inverse of what was discussed above.

If you buy a put option to open a trade, a decrease in stock price could result in profitability since you can now sell it for more than what you bought it for. An increase in the stock price could result in the put option decreasing in value, which would result in a loss if you closed it for less than what you bought it for up front.

If you sold a call option to open a trade, a decrease in the stock price could also result in profitability since you sold the option for a higher amount than what it’s trading for now as the stock price is further away from the strike, and buying back the option to close it for a lower amount than what you sold it for results in profitability. Conversely, if the stock price rises into your short call, the short call option could increase in value resulting in a loss if you buy it back for more than what you sold it for up front.

Remember, certain option strategies are susceptible to potential unlimited losses, such as selling to open a call option since there is no cap to how high a stock price can go.

A call option gives the owner the right to buy 100 shares of stock at the specified strike price and expiration date of the options contract.

Call contracts can be bought to open or sold to open on trade entry.

Long call contracts are bullish trades, and short call contracts are bearish trades.

A put option gives the owner the right to sell 100 shares of stock at the specified strike price and expiration date of the options contract.

Put contracts can be bought to open or sold to open on trade entry.

Long put contracts are bearish trades, and short put contracts are bullish trades.

Yes. Options trading in an IRA account is available at tastytrade, assuming the correct account type and trading levels are established. There are also higher margin requirements compared to non-retirement accounts for naked options and stock trades for example, as no leverage is allowed in a retirement account.

Options involve risk and are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially significant losses. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.

All investments involve the risk of loss. Please carefully consider the risks associated with your investments and if such trading is suitable for you before deciding to trade certain products or strategies. You are solely responsible for making your investment and trading decisions and for evaluating the risks associated with your investments.